Illuminati Investments

Tuesday

Systematic Corruption

Inside Job (2010) - the systemic corruption of the United States

Sunday

Barbarians at the Gate: The leveraged buyout (LBO) of RJR Nabisco

The acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition. Often, the assets of the company being acquired are used as collateral for the loans in addition to the assets of the acquiring company. The purpose of leveraged buyouts is to allow companies to make large acquisitions without having to commit a lot of capital.

In an LBO, there is usually a ratio of 90% debt to 10% equity. Because of this high debt/equity ratio, the bonds usually are not investment grade and are referred to as junk bonds. Leveraged buyouts have had a notorious history, especially in the 1980s when several prominent buyouts led to the eventual bankruptcy of the acquired companies. This was mainly due to the fact that the leverage ratio was nearly 100% and the interest payments were so large that the company's operating cash flows were unable to meet the obligation.

Too Big to FAIL - Blast from the past

"Too big to fail" is a colloquial term in regulation and public policy that refers to businesses dealing with market complications related to moral hazard, macroeconomics, economic specialization, and monetary theory.

Monday

Stealth Marketing

An awesome marketing movie. The Joneses work for LifeImage Enterprises, a stealth marketing company.

So, the Best Animated Business TV Show is…

South Park Season 13 Episode 3,Margaritaville

Simply a better version of Wall Street 2

Sunday

Goldman Sachs Global Rage Fund

Dear Investor:

Up until now, Goldman Sachs ($GS) has been silent on the subject of the protest movement known as Occupy Wall Street. That does not mean, however, that it has not been very much on our minds. As thousands have gathered in Lower Manhattan, passionately expressing their deep discontent with the status quo, we have taken note of these protests. And we have asked ourselves this question:

How can we make money off them?

The answer is the newly launched Goldman Sachs Global Rage Fund, whose investment objective is to monetize the Occupy Wall Street protests as they spread around the world. At Goldman, we recognize that the capitalist system as we know it is circling the drain – but there’s plenty of money to be made on the way down. The Rage Fund will seek out opportunities to invest in products that are poised to benefit from the spreading protests, from police batons and barricades to stun guns and forehead bandages. Furthermore, as clashes between police and protesters turn ever more violent, we are making significant bets on companies that manufacture replacements for broken windows and overturned cars, as well as the raw materials necessary for the construction and incineration of effigies.

It would be tempting, at a time like this, to say “Let them eat cake.” But at Goldman, we are actively seeking to corner the market in cake futures. We project that through our aggressive market manipulation, the price of a piece of cake will quadruple by the end of 2011.

Please contact your Goldman representative for a full prospectus. As the world descends into a Darwinian free-for-all, the Goldman Sachs Rage Fund is a great way to tell the protesters, “Occupy this.” We haven’t felt so good about something we’ve sold since our souls.

Sincerely,

Lloyd Blankfein

Chairman, Goldman Sachs

Friday

Freakonomics

Haven't read it yet? Don't worry. Here's the documentary.

Interested in business movies? If yes, click here; if no click here, if indifferent, click here

Tuesday

Binary Options Trading

Binary options trading is an exciting way people with limited capital have been able to make money in the stock market.

Binary options trading is an exciting way people with limited capital have been able to make money in the stock market.A binary option is a type of option where the payoff is either some fixed amount of some asset or nothing at all. The two main types of binary options are the cash-or-nothing binary option and the asset-or-nothing binary option. The cash-or-nothing binary option pays some fixed amount of cash if the option expires in-the-money while the asset-or-nothing pays the value of the underlying security. Thus, the options are binary in nature because there are only two possible outcomes. They are also called all-or-nothing options, digital options (more common in forex/interest rate markets), and Fixed Return Options (FROs) (on the American Stock Exchange). Binary options are usually European-style options.

For example, a purchase is made of a binary cash-or-nothing call option on XYZ Corp's stock struck at $100 with a binary payoff of $1000. Then, if at the future maturity date, the stock is trading at or above $100, $1000 is received. If its stock is trading below $100, nothing is received.

For a Binary Options Trading Tutorial, click here.

Sunday

Oh My That's AWESOME

"Discovery consists of seeing what everybody has seen and thinking what nobody has thought." — Albert von Szent-Gyorgy

http://www.ohmythatsawesome.com/

Wednesday

The network of global corporate control

Read more here

5 Shocking Rules for Investing in Today's Volatile Market

Rule #1: Why you shouldn’t buy any stock in the S&P 500 index!

Rule #2: Why you must ignore the asset allocation rules you’ve been conned into believing!

Rule #3: Why you must avoid the majority of mutual funds (they’re risker than you think--learn why)!

Rule #4: How you can protect yourself from the #1 threat to your money in the next 30 days!

Rule #5: The only stocks you should invest in today. These “shadow” stocks beat the market 14-to-1 over the last ten years!A Tale of Two Markets

Most investors don’t realize this, but there are really TWO stock markets out there.

Are you investing in the right one?

The first market is the one that institutions and most mutual funds invest in. This is the market where giant, large capitalization companies live. This is the market Wall Street hypes ‘til it’s blue in the face.

And, unfortunately, this is the market that most individual investors choose to invest in.

They invest in this market because the investment press, most investment books, investment advisors, and even their friends all urge them to.

This is the market where individual investors end up chasing stocks AFTER Wall Street, institutional investors, and large mutual funds have already driven a stock’s price artificially higher. This is the market that has gone nowhere for the last decade and destroyed the nest egg of tens of thousands of investors.

Following the herd into this market is the biggest threat to your wealth today...

Rule #1: Why You Shouldn't Buy Any Stock in the S&P 500 Index

You see, almost everything you read is authored by, influe

nced by, or in the interests of institutional investors. Yet the needs of institutions and big money managers are far different from your needs.

Wall Street and its hoards of institutional investors are primarily concerned with not doing worse than their competitors, so they focus on the short term becaus

e they want to keep their jobs.

They MUST buy the stock of large companies, like those found in the S&P 500 Index, because smaller companies don't have enough stock to satisfy th

e enormous needs of giant institutions. In fact, many mutual funds have rules forbidding them from investing in anything but large cap stocks.

This, coupled with a short-term focus leads the institutional marketplace to make very different decisions about buying and selling stocks than any rational long-term individual investor would make. In a nutshell, the performance of any large cap stocks you may own are subject to the whims and control of big institutional investors.

Here's the game they play. The large institutions and brokerage houses tout these large companies because they underwrite them and mus

t continue to support them because they have a vested financial interest in driving their stock price ever higher. So they push them to individuals like you and me - just before the floor falls out.

In this market, you are a pawn in Wall Street's big money game. That's just one of the reasons we advise investors like you to avoid large cap stocks like those found in the S&P 500 Index.

But there is another market. A market we have mined successfu

lly over the last 10 years to deliver a stunning 430% return while the S&P 500 returned just 30%. I'm going to tell you about it in just a moment, but first let me tell you why you should ignore everything you think you know about asset allocation.

Rule #2: Ignore the Asset Allocation Myth

If you've ever opened a financial magazine, talked with a broker or financial planner or listened to any financial "expert" on TV, you've surely heard the typical asset allocation recommendations.

They'll say something like: at age 50 you should be 10% in cash, 25% in bonds and 65% in stocks (divided among different capitalizations, different countries, value versus growth, etc.).

Those of you, like me, who have been around for a few years may remember Adele Davis, the famous nutritionist. When she lectured she would invariably get questions like "How good are fruits and vegetables for me?" and she would reply: "Which fruits? Which vegetables?"

Along those lines, when it comes to generic asset allocation recommendations, I would say: "Which stocks, which bonds?" Talking about allocation without knowing which stocks and which bonds is meaningless.

Show me a portfolio with 65% in a stock index fund and 35% in a bond index fund, and I will be able to show you a 100% stock portfolio that is less risky and a 100% bond portfolio that is more risky!

Same goes for the hogwash you hear about growth stocks versus value stocks as an allocation consideration.

Come on now! Someone has gone to the trouble of dividing all stocks in half, based on various criteria and calling half of them value and half growth. And then they suggest you divide your holdings according to this definition.

I am a value investor, and by my criteria, not more than 15% of the stocks out there should be termed value stocks. I have friends who are momentum investors and they wouldn't call more than 15% of the stocks growth stocks. If you're diversifying using all those stocks in the middle, you may not be diversifying at all.

Since we are on the subject of risk and diversification, let's take a moment to discuss one more of those rules for protecting your portfolio in today's turbulent times.

Rule #3: Avoid These Mutual Fund Traps

We recognize that many investors do not have the time to manage portfolios of individual stocks or bonds so they turn to mutual funds.

But all too often, they invest in the "me too" large-cap funds that pull you into the institutional market. A market that we've already illustrated is bad for the individual investor.

Index funds are another popular choice, but they too are riskier than you think!

It may seem strange to you that a portfolio of 500 stocks would be riskier than a smaller portfolio of stocks chosen for risk reduction. But consider this: In the S&P 500 index, the top 10 stocks account for 21% of the portfolio.

On top of that, many of the largest stocks are in the same industries - further reducing diversification and increasing risk. Remember all the financial stocks that imploded over the past few years? And the tech stocks before that?

And index funds are among the best of the funds investing in large companies. Most other funds have the same problems, plus higher management and transaction costs.

Now, mutual funds DO have a place. But your focus should be on funds that concentrate on risk reduction or small and mid-cap stocks or funds that have a truly unique approach. Helping investors like you uncover funds that do just that is one of the many things we do. Our easy to follow model mutual fund and ETF portfolios safely keep you out of the institutional marketplace and serve as a quick guide to the kinds of funds you should be paying attention to.

You can get complete unlimited access to these portfolios free - I'll tell you how in just a moment. But first let's talk about the biggest threat to your wealth today...

Rule #4: Protect Yourself from the Biggest Threat to Your Money Today

Investors are faced with a daily barrage of business news. There's keen competition over who can break the story first. Who can come up with the "catchiest" headline.

The clear inference is that the news matters - that keeping abreast of the news, especially as it relates to one's holdings, is one of the keys to investment success.

I disagree. In fact, today's 24-hour financial news cycle is one of the biggest threats to your long-term investing success - especially in today's volatile market! Almost everything the daily media reports on from an investment perspective is guesswork, speculation or hype. This-never ending reporting cycle causes many investors to make decisions at the wrong time and for the wrong reasons. Regrettably, institutional money managers know this and appreciate the fact that the investor's missteps help them build profits - day in and day out.

As an investor, you only need to pay attention to the handful of true big surprises that are reported on over the course of the year. Not the never-ending flood of routine daily news that is insignificant and meaningless in terms of real impact to your portfolio.

In truth, most news only serves importance for PR firms, journalists, day traders and TV reporters because it gives them a means of making a living. But to the long-term investor like you, it is little more than filler and noise.

What makes the impact of news even more nebulous is this: There is almost always both good news and bad news about a stock. In addition, the news story itself almost always has both a positive and negative aspect.

It is a myth that what's reported by the financial media is factual. Over the years we have been conditioned by Wall Street and the financial media to believe that stocks move up and down for identifiable and reportable reasons. What passes as facts are likely guesses that may or may not be pertinent to a particular stock or the direction of the overall economy. What can be said with confidence is that the one thing that is not random or irrational about the market's performance is its basic, underlying, 100-year entrenched uptrend.

A Smarter Way to Invest

(Beat the Market 14-to-1)

Over the last 10 years, AAII has used the investing rules in this report to deliver a stunning 430% return while the S&P 500 returned just 30%. We did it by ignoring the herd mentality on Wall Street, and instead investing in the "other" stock market.

This market is made up of companies with small to medium capitalizations and solid underlying values. There are none of the sluggish large-cap stocks that the institutions are stuck with. There are also none of the start-up companies without earnings that are only suitable for venture capitalists.

It's the market where "Shadow Stocks" live.

Rule #5: Use Shadow Stocks — The Secret to Beating the Market

If at the end of 1940 you had invested $1,000 in the stocks of the S&P 500, you would now have $1,330,777 (reinvesting dividends and ignoring taxes). Not bad.

But if you had invested the same $1,000 in Shadow Stocks, you would now have $13,798,707!

Shadow Stocks are small-company stocks with underlying values that are overlooked by institutions and not covered much by analysts. And they can make a truly life-changing difference in your investing results.

Is the U.S. in a Debt Spiral?

Sunday

Consulting: Kazi Consulting Group

KCG is a management and marketing consulting firm. We collaborate with clients to identify their highest-value opportunities and address their most critical challenges to ultimately transform their businesses. KCG looks beyond standard solutions to develop new insights, mobilize businesses, and drive innovation.

Core Services

• Business Registration

• Business Incubation

• Business Consulting

• Digital Marketing

• Creation and Development of Green Business Strategies

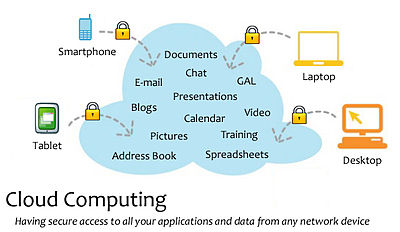

Tech Watch: 90 Cloud Computing Companies to Watch in 2011

Cloud computing refers to the on-demand provision of computational resources (data, software) via a computer network, rather than from a local computer. Users or clients can submit a task, such as word processing, to the service provider, without actually possessing the software or hardware. The consumer's computer may contain very little software or data (perhaps a minimal operating system and web browser only), serving as a basic display terminal connected to the Internet. Since the cloud is the underlying delivery mechanism, cloud based applications and services may support any type of software application or service in use today.

90 Cloud Computing Companies to Watch in 2011

- Amazon

- Salesforce.com

- Google Apps

- VMWare

- Rackspace

- Equinix

- Zuora

- Hosting.com

- rPath

- Joyent

- Appistry

- Terremark Worldwide

- Navisite

- Rightscale

- GoGrid

- NetSuite

- Eucalyptus

- CohesiveFT

- Red Hat

- Savvis

- Citrix

- Appirio

- Parallels

- SuccessFactors

- SoftLayer

- Relational Networks

- AppZero

- Datapipe

- Enomaly

- Intacct

- Caspio

- Sungard

- Astadia

- Bluewolf

- CloudShare

- LayeredTech

- Voxeo

- CloudSwitch

- Nubifer

- Cordys

- Tropo

- Cloudera

- Clustercorp

- Adaptive Computing

- GigaSpaces

- Crosscheck Networks

- Egnyte

- GoodData

- Nasuni

- Whamcloud

- Navajo Systems

- Jive Software

- Symplified

- Virtual Ark

- Workbooks

- Constant Contact

- FreshBooks

- Intuit

- Model Metrics

- Vertica

- Zoho

- 37Signals

- Practice Fusion

- Basic Gov

- Imonggo

- iCloud

- JumpBox

- Nirvanix

- OpenNebula

- Flexiant

- Nimbus

- GreenQloud

- Cloudant

- enStratus

- GridCentric

- Okta

- Nimbula

- Nimsoft

- PanTerra Networks

- Apptix

- Engine Yard

- Gladinet

- Twilio

- Cloud.com

- ReliaCloud

- Kaavo

- Intalio

- Workday

- Arjuna

Friday

Tech Watch: Twitter List Building

How To Use Twitter to Grow Your Email Opt-In List for FREE!

How To Use Twitter to Grow Your Email Opt-In List for FREE!INTRODUCTION

The Goal: Move your fans off of Twitter and onto your email opt-in list as quickly as possible, since most people that join Twitter are only around for 30-60 days.

STEP 1: Build your follower list in Twitter

STEP 1: GETTING FOLLOWERS

The "big secret" to building a list of followers is to FOLLOW FIRST.

- Weekends (esp. Sunday nights)

- Weekdays (1pm - 3pm EST) & (6pm - 10pm EST)

- Mornings suck

Good to follow people that don't follow a lot of people (but still are active), because when you send a message, it will sit in their timeline longer.

Find a local list of followers in search.twitter.com (search "live in Austin")

Check out twitter.com/WholeFoods

Best days to tweet (from sysomos.com/insidetwitter/)

- Tuesdays and Wednesdays are the best (16% of Twitter users are active on average)... you wanna tweet when other people are actively using Twitter

- Sundays are the worst days to tweet (not good for getting a message spread), but the best time to follow... people go in and manage their account on Sunday ("housekeeping"), more than they talk.

- IMPORTANT: You never know when your people will be online, so your best bet is to tweet 7 days a week.

Best times to tweet (from sysomos.com/insidetwitter/)

- Afternoons (11am - 3pm EST)

- Mornings aren't great, but if you can you should still have a morning tweet "block"

Tweeting in "blocks"

- One tweet has virtually no impact (gets lost in the timeline)

Sources of pre-tested content

Google Alerts

- Not "pre-tested" content... but still good, and usually only big stories

- Typically use "Comprehensive" setting

- "Once a day" setting

Digg.com

- Super recent stories

- Content that gets the most reaction from people

- More general content -- although current, and hip

STEP 3: BLENDING IN DISGUISED CONTENT

(Moving people from Twitter to your opt-in list)

METHOD 1: Tweet to content on your blog (which should have an opt-in offer) - Most passive

- Make a post on your blog that sends them to the story on the original site

- Could make a short video sharing your thoughts on the content you're linking to

- Ex. drivingtraffic.com > "Should I unfriend my Facebook friends like Ed Dale?"

- Use Camptasia or JingProject (free version of Camptasia)

- Lowest opt-in rate

METHOD 2: Tweet to webinar/teleseminar registrations - Passive but most effective

- People are OK with this... they get excited about it

CONTENT/PROMO RATIO

You can continue to tweet to the same 4 blogs posts, etc.

EXAMPLES: DISGUISED CONTENT IN ACTION

Example Tweet: ryandeiss 2 social media "cheat sheets" (PDFs) --> http://budurl.com/3dn2

- Let them know the format -- People understand that in order to get "PDFs", "MP3s", "VIDEOs",

etc., they'll probably have to register

- GoToWebinar.com

OUTSOURCE AND AUTOMATE

Hire an assistant to follow and tweet for you

Use TweetLater.com to automate your tweeting (esp. your disguised content)

- Ryan does not recommend auto-following... doesn't get you the right kind of audience, and it can get you banned

DEMO: USING TWEETLATER

Perry and Ryan do not recommend using auto-reply... they're obnoxious and don't get a great result. Especially don't send people to a squeeze page.

You can use the "Disguised/Promo Content" section for a month or more without changing anything

The Top 50 Control Holders*

BARCLAYS PLC (GB)

THE CAPITAL GROUP COMPANIES INC (US)

FMR CORP (US)

AXA (FR)

STATE STREET CORPORATION (US)

JPMORGAN CHASE & CO. (US)

LEGAL & GENERAL GROUP PLC (GB)

THE VANGUARD GROUP, INC. (US)

UBS AG (CH)

MERRILL LYNCH & CO., INC. (US)

WELLINGTON MANAGEMENT CO. L.L.P. (US)

DEUTSCHE BANK AG (DE)

FRANKLIN RESOURCES, INC. (US)

CREDIT SUISSE GROUP (CH)

WALTON ENTERPRISES LLC (US)

BANK OF NEW YORK MELLON CORP. (US)

NATIXIS (FR)

THE GOLDMAN SACHS GROUP, INC. (US)

T. ROWE PRICE GROUP, INC. (US)

LEGG MASON, INC. (US)

MORGAN STANLEY (US)

MITSUBISHI UFJ FINANCIAL GROUP, INC. (JP)

NORTHERN TRUST CORPORATION (US)

SOCIÉTÉ GÉNÉRALE (FR)

BANK OF AMERICA CORPORATION (US)

LLOYDS TSB GROUP PLC (GB)

INVESCO PLC (GB)

ALLIANZ SE (DE)

TIAA (US)

OLD MUTUAL PUBLIC LIMITED COMPANY (GB)

AVIVA PLC (GB)

SCHRODERS PLC (GB)

DODGE & COX (US)

LEHMAN BROTHERS HOLDINGS, INC. (US)

SUN LIFE FINANCIAL, INC. (CA)

STANDARD LIFE PLC (GB)

CNCE (FR)

NOMURA HOLDINGS, INC. (JP)

THE DEPOSITORY TRUST COMPANY (US)

MASSACHUSETTS MUTUAL LIFE INSUR. (US)

ING GROEP N.V. (NL)

BRANDES INVESTMENT PARTNERS, L.P. (US)

UNICREDITO ITALIANO SPA (IT)

DEPOSIT INSURANCE CORPORATION OF JP (JP)

VERENIGING AEGON (NL)

BNP PARIBAS (FR)

AFFILIATED MANAGERS GROUP, INC. (US)

RESONA HOLDINGS, INC. (JP)

CAPITAL GROUP INTERNATIONAL, INC.(US)

CHINA PETROCHEMICAL GROUP CO. (CN)